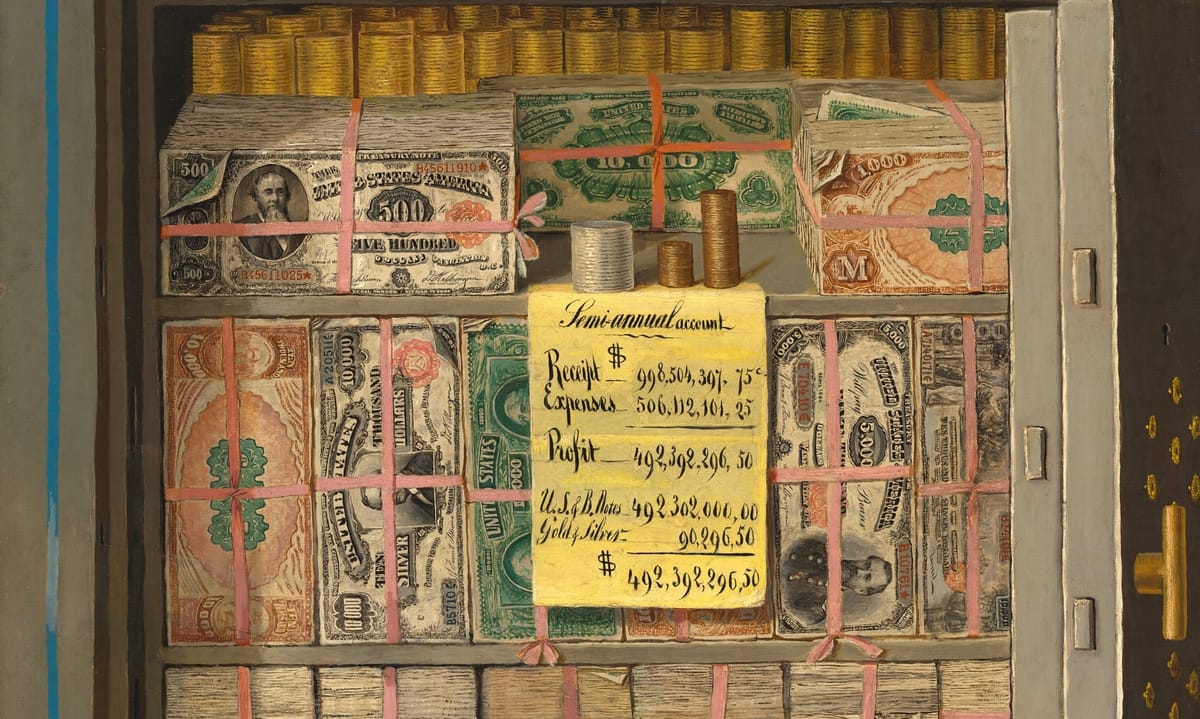

AI: This "Bubble" Is Stuffed With Money

If there's an inflating AI bubble, it's a bubble stuffed with money. NVIDIA's earnings on August 28th could burst it again and unleash a cash bonanza for investors.

Disclosure: The author holds a beneficial long position in Nvidia Corporation (NASDAQ: NVDA). This article is provided for informational and entertainment purposes only and does not constitute financial advice. The views expressed here represent the author’s personal opinion. The author receives no compensation for this article and has no business relationship with the company mentioned. Please see the full "Legal Information and Disclosures" section below.

In December 2023, I wrote an article about why it might be difficult to recognize an AI bubble as such. Maybe it's me who's now saying the typical top-of-the-bubble phrase: "This time it's different" - I may be a fool, but I don't see a bubble involving some of the most profitable companies in history, such as NVIDIA, Microsoft, Alphabet, Meta, Apple and others.

Paradoxically, it may be the very success of these companies that has prevented a bubble from forming: The stellar earnings reported each quarter act as a leash, preventing the prices that euphoric so-called growth investors are willing to pay from straying too far from the fundamentals.

Bubbles form when investors' imaginations become disconnected from reality. The best breeding ground for wild growth fantasies is an unprofitable company (or sector) with an exciting story. Then, instead of earnings, nonsensical metrics such as total addressable market (TAM) or, in the case of the dot-com bubble, the infamous "price per clicks" fuel investors' fantasies.

Real earnings, on the other hand, often bore today's growth investors looking for the next ten baggers. Real earnings rarely explode, and even when they do, they still create a center of gravity from which it seems unrealistic to extrapolate further exponential growth. At the same time, exploding earnings paradoxically quickly lead to the loudest voices crying bubble: it can always be argued that a profitable company is trading at a too high price-to-earnings (P/E) ratio, while one simply cannot calculate a P/E ratio for an unprofitable company.

A good example is NVIDIA, where all sorts of arguments are being used to question the sustainability of its stellar revenue and earnings growth. One argument often heard from NVIDIA bears is that its major customers are a handful of other technology companies. However, this means that NVIDIA has already achieved this incredible growth with so few large customers. We are still at the beginning of the AI revolution, at the end of which I believe AI will permeate all industries. With subscription models like Enterprise AI, NVIDIA could win dozens of additional large customers in industries such as pharmaceuticals, chemicals, film, finance, and more, without other tech giants acting as middlemen.

Most of the companies involved in the AI revolution were already profitable before the AI revolution took off with the release of ChatGPT in November 2022. In fact, the stock prices of companies like NVIDIA have mostly risen after, not before, each quarterly earnings report over the past two years, meaning that real fundamentals have been fueling investor euphoria.

NVIDIA's quarterly earnings per share grow from $0.08 in April 2023 to $0.60 in April 2024, that's a 650% increase, while the stock has gone up about 200% since the Q1 2023 results were released at the end of May 2023. That is not the anatomy of a bubble, in my opinion. And even when it looks like a bubble is forming for a short time, it deflates immediately: How could a real bubble form in the midst of a market sentiment where, for example, Microsoft is immediately punished for 29% growth in cloud services instead of the expected 30% to 31%, as happened after the July 30th Q4 earnings report? If there is an inflating AI bubble, it's a bubble stuffed with money. NVIDIA's earnings on August 28th could burst it again and unleash a cash bonanza for investors.

Follow me on X for frequent updates (@chaotropy).

Legal Information and Disclosures

General Disclaimer & No Financial Advice: The content of this article is for informational, educational, and entertainment purposes only. It represents the personal opinions of the author as of the date of publication and may change without notice. The author is not a registered investment advisor or financial analyst. This content is not intended to be, and shall not be construed as, financial, legal, tax, or investment advice. It does not constitute a personal recommendation or an assessment of suitability for any specific investor. Readers should conduct their own independent due diligence and consult with a certified financial professional before making any investment decisions.

Accuracy and Third-Party Data: Economic trends, technological specifications, and performance metrics referenced in this article are sourced from independent third parties. While the author believes these sources to be reliable, the completeness, timeliness, or correctness of this data cannot be guaranteed. The author assumes no liability for errors, omissions, or the results obtained from the use of this information.

Disclosure of Interest: The author holds a beneficial long position in the securities of Nvidia Corporation (NASDAQ: NVDA). The author reserves the right to buy or sell these securities at any time without further notice. The author receives no direct compensation for the production of this content and maintains no business relationship with the companies mentioned.

Forward-Looking Statements & Risk: This article contains forward-looking statements regarding product adoption, technological trends, and market potential. These statements are predictions based on current expectations and are subject to significant risks and uncertainties. Investing in technology and growth stocks is speculative, subject to rapid change and competition, and involves a risk of loss. Past performance is not indicative of future results.

Copyright: All content is the property of the author. This article may not be copied, reproduced, or published, in whole or in part, without the author's prior written consent.