NVIDIA: No Bubble Yet

NVIDIA is selling the tools for the AI revolution, and every industry will gradually adopt AI, just as the software industry has. This would allow NVIDIA to not only maintain its current revenue growth rate, but even increase it.

Disclosure: The author holds a beneficial long position in Nvidia Corporation (NASDAQ: NVDA). This article is provided for informational and entertainment purposes only and does not constitute financial advice. The views expressed here represent the author’s personal opinion. The author receives no compensation for this article and has no business relationship with the company mentioned. Please see the full "Legal Information and Disclosures" section below.

Taiwan as the world's production center for high-end chips and especially NVIDIA's GPUs reminds me of the desert planet Arrakis in Frank Herbert's Dune. Just as the spice necessary for interstellar travel can only be produced on Arrakis, the chips necessary for Large Language Models (LLMs) can only be produced in Taiwan. Since NVIDIA's H100 chips enable artificial intelligence in all its applications, they have become a geopolitical resource, with Saudi Arabia or the United Arab Emirates, for example, buying them at scale for strategic reasons. Although competitor AMD recently made progress with the release of its MI300 chips, NVIDIA is still ahead of the race. NVIDIA's H100 remains the gold standard - the spice - for AI infrastructure and is still superior to AMD's MI300. As a result, NVIDIA maintains an economic moat that it can even widen through massive investments in research and development.

Given the current hype around AI, it is understandable that investors are reminded of the dot-com bubble, but it may be far too early for that. According to George Soros, stock market bubbles are much more complex than simply inflated price-earnings ratios. After all, it was not a misjudgement of the future impact of the Internet in the late 1990s that led to a bubble, but rather a misjudgement of the time frame in which the Internet could actually increase the productivity and efficiency of our economies. However, the impact of generative AI on businesses and our economy may become measurable much more quickly. The most obvious area of early adoption of generative AI to date has been in computer programming and software development, where it is already happening at breathtaking speed. As early as July 2023, experts at McKinsey estimated that AI could double the speed of production in the software industry. Thousands of companies are already using Github Copilot, and more than a million users are paying for the service. NVIDIA CEO Jensen Huang recently predicted "that the programming language is human, everybody in the world is now a programmer. This is the miracle of artificial intelligence" - coding is dead. AI will enable a whole new way of interacting with computers. But it's not just about assisting with coding: On March 5, for example, cybersecurity company Crowdstrike released its fiscal year 2024 results, reporting better than expected revenue and guidance. A key product is Charlotte AI, an artificial intelligence that democratizes cybersecurity management by enabling natural language interaction.

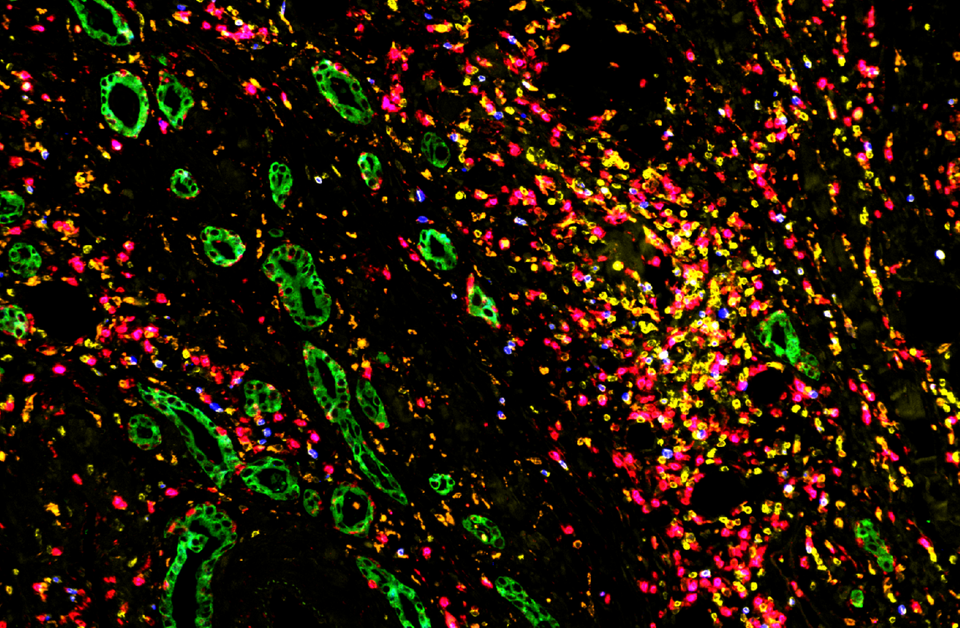

More exciting for NVIDIA's future, however, are the areas where generative AI has not yet been adopted at scale. For example, while there seems to be a consensus on the potential of AI, there has been little to no day-to-day application of AI in healthcare and medicine. We are still a long way from AI actually performing diagnostics, making diagnoses, interpreting medical imaging or histopathology slides, or even performing interventions on patients in the everyday world. AI could also soon revolutionize research in the chemical industry, simplify processes in old heavy industries, create all kinds of content for movies and video games or even turn government bureaucracies upside down. For example, the city of Heidelberg in southern Germany is already experimenting with an AI chatbot (Lumi by Aleph Alpha) to help people deal with government agencies and answer questions about the complex German bureaucracy. In my opinion, it is foreseeable that sooner or later AI will find its way into every niche of our civilization.

NVIDIA is selling the basic tools for this revolution, and every industry will gradually adopt generative AI, just as the software industry has. As if that were not enough of a tailwind, the next bitcoin halving is approaching (likely in April 2024). Mining bitcoins will then become more computationally intensive, which should further increase demand for NVIDIA's energy-efficient GPU chips. All of this could allow NVIDIA to not only maintain its current revenue growth rate (recently reported revenue growth was 126% year-over-year), but even increase that rate. Of course, that's hard to imagine with NVIDIA's current market cap of more than $2 trillion, or as physicist Albert A. Bartlett once wrote: "The greatest shortcoming of the human race is our inability to understand the exponential function." Remember what they say in the world of Dune? - "The spice must flow."

Follow me on X for frequent updates (@chaotropy).

Legal Information and Disclosures

General Disclaimer & No Financial Advice: The content of this article is for informational, educational, and entertainment purposes only. It represents the personal opinions of the author as of the date of publication and may change without notice. The author is not a registered investment advisor or financial analyst. This content is not intended to be, and shall not be construed as, financial, legal, tax, or investment advice. It does not constitute a personal recommendation or an assessment of suitability for any specific investor. Readers should conduct their own independent due diligence and consult with a certified financial professional before making any investment decisions.

Accuracy and Third-Party Data: Economic trends, technological specifications, and performance metrics referenced in this article are sourced from independent third parties. While the author believes these sources to be reliable, the completeness, timeliness, or correctness of this data cannot be guaranteed. The author assumes no liability for errors, omissions, or the results obtained from the use of this information.

Disclosure of Interest: The author holds a beneficial long position in the securities of Nvidia Corporation (NASDAQ: NVDA). The author reserves the right to buy or sell these securities at any time without further notice. The author receives no direct compensation for the production of this content and maintains no business relationship with the companies mentioned.

Forward-Looking Statements & Risk: This article contains forward-looking statements regarding product adoption, technological trends, and market potential. These statements are predictions based on current expectations and are subject to significant risks and uncertainties. Investing in technology and growth stocks is speculative, subject to rapid change and competition, and involves a risk of loss. Past performance is not indicative of future results.

Copyright: All content is the property of the author. This article may not be copied, reproduced, or published, in whole or in part, without the author's prior written consent.