Frequency Electronics: From Voyager To The Space Economy

Since 1961, Frequency Electronics' precision timing instruments have kept the Voyager and Apollo missions, as well as over 1,000 satellites, synchronized with Earth. With an expected increase in commercial satellites and UAVs, demand for FEIM's atomic clocks is expected to surge.

Disclosure: The author holds a beneficial long position in Frequency Electronics, Inc. (NASDAQ: FEIM). This article is provided for informational and entertainment purposes only and does not constitute financial advice. The views expressed here represent the author’s personal opinion. The author receives no compensation for this article and has no business relationship with the company mentioned. Please see the full "Legal Information and Disclosures" section below.

A Heritage of Six Decades of Precision Timing

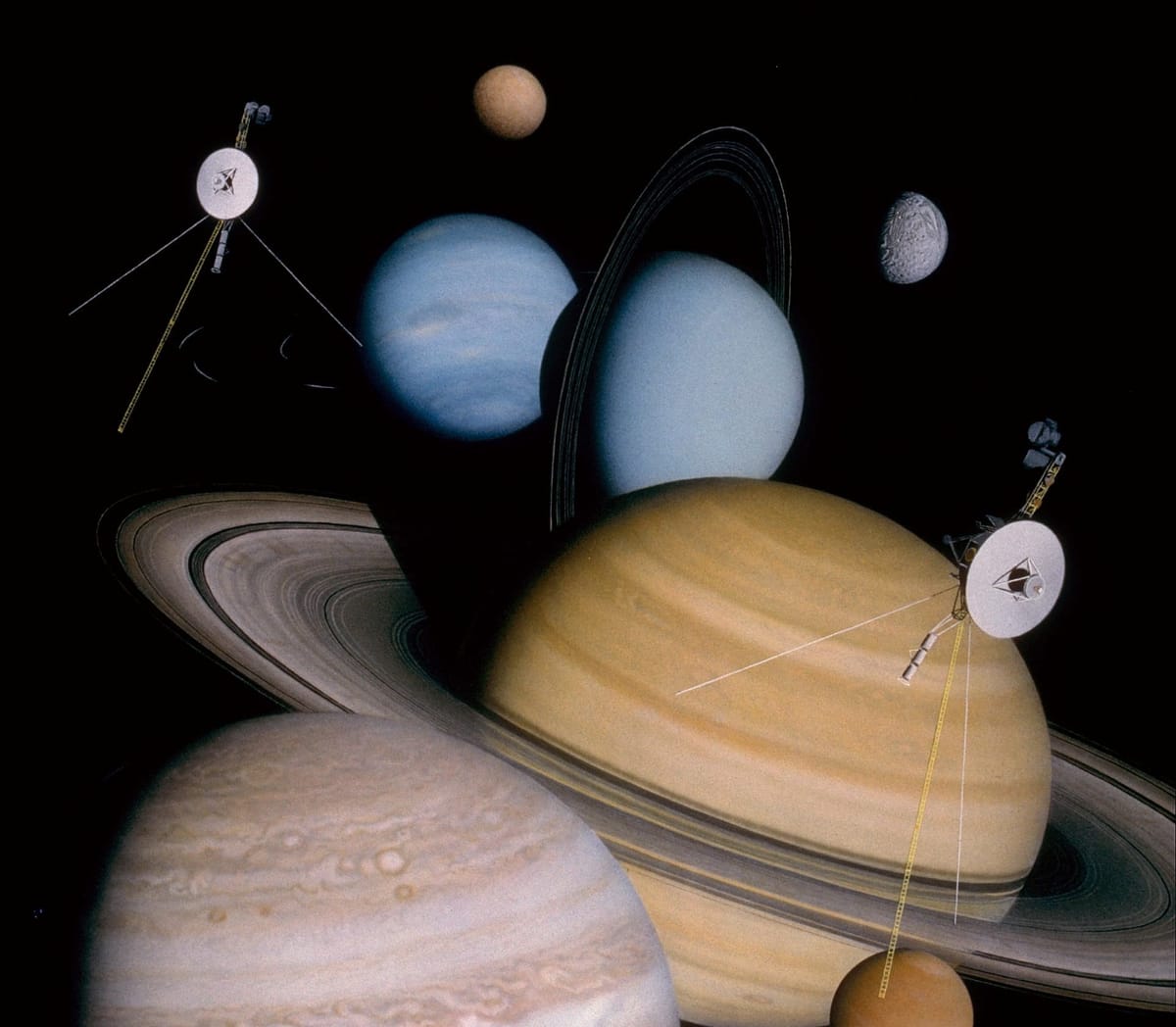

Time behaves differently once you leave Earth. Since radio signals must travel millions of miles, every spacecraft needs an onboard reference to keep it synchronized with ground control. Since 1961, Frequency Electronics, Inc. (NASDAQ: FEIM) has supplied these references. Its quartz modules have kept the twin Voyager probes communicating with Earth since 1977—the longest‑running space clocks in history—and earlier master clocks flew on the Nimbus and TIROS weather satellites as early as 1962. FEIM hardware has stabilized Apollo communications, Hubble’s cameras, and Kepler’s exoplanet hunt. In total, the Uniondale, New York, manufacturer has delivered over 5,000 precision assemblies for more than 1,000 satellites and subsea vehicles. This has earned FEIM a 2025 Northrop Grumman Supplier Excellence Award and repeat business from Lockheed Martin for the GPS III program.

LEO Constellations & UAVs: A Booming Market

The space economy is booming as commercial players launch thousands of communication and Earth‑observation satellites. These satellites depend on precise timing and frequency control — a niche in which FEIM specializes. The focus in space is shifting from bespoke science missions to commercial infrastructure. Low‑Earth‑orbit (LEO) broadband constellations alone are expected to surpass 50,000 satellites by the end of the decade. SpaceX’s Starlink already has roughly 8,000 satellites and has hinted at using them for navigation. While experimental positioning trials confirm this concept, clock instability on Starlink vehicles—none of which fly with atomic clocks—still limits accuracy. AST SpaceMobile plans to launch “cell towers in space” that must phase‑lock with 4G/5G terrestrial networks, which requires even stricter timing. Neither company discloses its suppliers, but radiation‑hardened oscillators with one‑billionth‑of‑a‑second‑per‑day drift—the specifications that FEIM meets for GPS III—are indispensable for any global constellation.

Beyond low Earth orbit (LEO), deep‑space exploration is scaling up. NASA’s Artemis lunar landers, the Lunar Gateway outpost, and planned Mars transports require onboard clocks precise enough to enable autonomous navigation, given that radio signals take minutes to reach Earth. The agency’s Deep Space Atomic Clock (DSAC) experiment, built around a FEIM ultra‑stable quartz oscillator, proved that a toaster‑sized atomic standard can guide probes across the solar system. Closer to home, swarms of military drones require phase‑aligned links and inertial dead reckoning in GPS‑denied airspace. FEIM’s new TURbO miniature rubidium clock, scheduled to be qualified by 2025, is designed to address the $20 million drone‑timing market by fiscal year 2027. All three growth areas—LEO communications, deep‑space infrastructure, and autonomous defense platforms—rely on the company’s core competency: uncompromising stability under radiation, vibration, and extreme temperatures.

From Quartz to Quantum

FEIM’s catalog focuses on oven-controlled quartz oscillators (OCXOs) and rubidium atomic frequency standards (RAFS). These products are available as standalone clocks or as master timing systems that distribute reference signals across an entire satellite bus. FEIM supplied the Ultra-Stable Oscillator for DSAC’s mercury-ion clock and continues to deliver frequency synthesizers, converters, and distribution amplifiers that route signals with picosecond fidelity. Leveraging its expertise in atomic physics, FEIM is expanding into quantum sensing. An NV-diamond magnetometer and a Rydberg-atom field sensor are under development with external funding, allowing the company to enter defense and scientific niches that few rivals can access.

The latest launch, the compact TURbO rubidium standard, brings space-grade precision to unmanned drones and airborne radars. As the U.S. Department of Defense aims to increase domestic drone production, FEIM forecasts significant revenue from this product line beginning in fiscal year 2026, surpassing $20 million by 2027. The message is clear: expertise forged in orbit is spilling into terrestrial aerospace and defense applications, expanding the firm’s total addressable market without compromising its technological advantage.

Competitive Edge: High-Reliability Moat

The atomic clock manufacturing industry is dominated by Microchip (Symmetricom/Microsemi), Safran-Orolia, Oscilloquartz, and a few aerospace companies. Yet FEIM occupies the high-reliability corner of the performance map. Its U.S. production, ITAR compliance, and six-decade flight record create switching costs that competitors struggle to overcome. Once a clock is qualified for a spacecraft or weapons platform, the risk of redesign discourages substitution throughout the program's lifetime. Ongoing R&D in optically pumped rubidium aims to reduce size, weight, and power by tenfold, which will further strengthen FEIM's position as demand for compact, radiation-tolerant clocks accelerates. Northrop’s 2025 award and Lockheed’s $5.9 million “Digital Rubidium Atomic Frequency Standard” contract for GPS IIIF validate FEIM’s standing as the go-to supplier when failure is not an option.

An Undervalued Strategic Asset

On July 10, FEIM, reported that revenue in fiscal year 2025 hit record levels, driven by satellite payload sales of $40.9 million—59 percent of the total revenue, which was nearly double that of the previous year's space orders. U.S. government and Department of Defense systems contributed $26.5 million, while commercial and industrial customers accounted for only 3 percent. However, backlog fell from $78 million to $70 million as accelerated deliveries pulled fiscal 2026 revenue into 2025, temporarily skewing comparisons and prompting management to caution against expecting another blowout quarter. On July 11, the stock sank by about 13 percent on the news.

Investors were also concerned when the initial guidance earmarked only $1–2 million of fiscal 2026 sales for the new TURbO clock. On July 11, 2025, management clarified that the figure reflects early bookings, not demand, and reiterated the $20 million drone-timing TAM. The short-term "air pocket" in orders highlights the volatility of government procurement but does not change the long-term trajectory. Meanwhile, the market prices FEIM at roughly eight times trailing earnings and 2.7 times sales—a weak multiple for a company focused solely on satellite and quantum timing technologies. Even a low single-digit share of forthcoming LEO constellations or UAV fleets could generate revenue comparable to the company's current run rate, while the established base of NASA and national security programs mitigates downside risk.

Conclusion: Timing the New Space Boom

From the weather satellites of the 1960s to the Voyager interstellar mission, Frequency Electronics has quietly ensured that some of humanity's most daring machines remain synchronized with Earth. As the world races to blanket the planet with broadband, build permanent outposts on the Moon, send crews to Mars, and deploy thousands of autonomous aircraft, the need for reliable clocks is growing. With its unmatched heritage, technical expertise, and growing financial success, FEIM is positioned as a small-cap gateway into the heart of the new space economy—an investment whose timing may prove to be just right.

Follow me on X for frequent updates (@chaotropy).

Legal Information and Disclosures

General Disclaimer & No Financial Advice: The content of this article is for informational, educational, and entertainment purposes only. It represents the personal opinions of the author as of the date of publication and may change without notice. The author is not a registered investment advisor or financial analyst. This content is not intended to be, and shall not be construed as, financial, legal, tax, or investment advice. It does not constitute a personal recommendation or an assessment of suitability for any specific investor. Readers should conduct their own independent due diligence and consult with a certified financial professional before making any investment decisions.

Accuracy and Third-Party Data: Economic trends, technological specifications, and performance metrics referenced in this article are sourced from independent third parties. While the author believes these sources to be reliable, the completeness, timeliness, or correctness of this data cannot be guaranteed. The author assumes no liability for errors, omissions, or the results obtained from the use of this information.

Disclosure of Interest: The author holds a beneficial long position in the securities of Frequency Electronics, Inc. (NASDAQ: FEIM). The author reserves the right to buy or sell these securities at any time without further notice. The author receives no direct compensation for the production of this content and maintains no business relationship with the companies mentioned.

Forward-Looking Statements & Risk: This article contains forward-looking statements regarding product adoption, technological trends, and market potential. These statements are predictions based on current expectations and are subject to significant risks and uncertainties. Investing in technology and growth stocks is speculative, subject to rapid change and competition, and involves a risk of loss. Past performance is not indicative of future results.

Copyright: All content is the property of the author. This article may not be copied, reproduced, or published, in whole or in part, without the author's prior written consent.