Abivax's Obefazimod: A (French) Revolution In IBD Treatment

Abivax's obefazimod offers a novel oral approach to treat ulcerative colitis by activating miR-124 to downregulate specific pro-inflammatory pathways. Following impressive results in clinical Phase 3 studies, buyout rumors surrounding the French biotech are surging.

Disclosure: The author holds a beneficial long position in Abivax Société Anonyme (NASDAQ: ABVX). This article is provided for informational and educational purposes only and is not financial advice. Although the author is a Medical Doctor, this content represents a personal opinion regarding the company’s science and market potential and is not medical advice, a diagnosis, or a treatment recommendation. The author receives no compensation for this article and has no business relationship with the company mentioned. Please see the full "Legal Information and Disclosures" section below.

During my residency in general surgery, I often saw patients with therapy-refractory inflammatory bowel disease (IBD), like ulcerative colitis, who have exhausted all medical options. For some of these individuals, the only remaining path is life-altering surgery that results in a permanent ostomy or an ileoanal pouch. These patients are often relatively young, and sometimes even younger than me.

While medical treatment for IBD has made huge progress over the last few decades, we must not forget that many patients simply do not respond sufficiently to existing regimens. That is why I was so excited when I read about the Phase 3 results from French biotech company Abivax’s obefazimod, a first-in-class oral miR-124 enhancer for ulcerative colitis, released in July 2025.

The current standard of care has evolved from symptom control to mucosal healing through agents that block specific cytokines, such as TNF-alpha and IL-23, or signaling pathways like Janus kinase (JAK). However, primary non-response and secondary loss of efficacy remain common, creating a competitive opening for therapies with distinct modes of action.

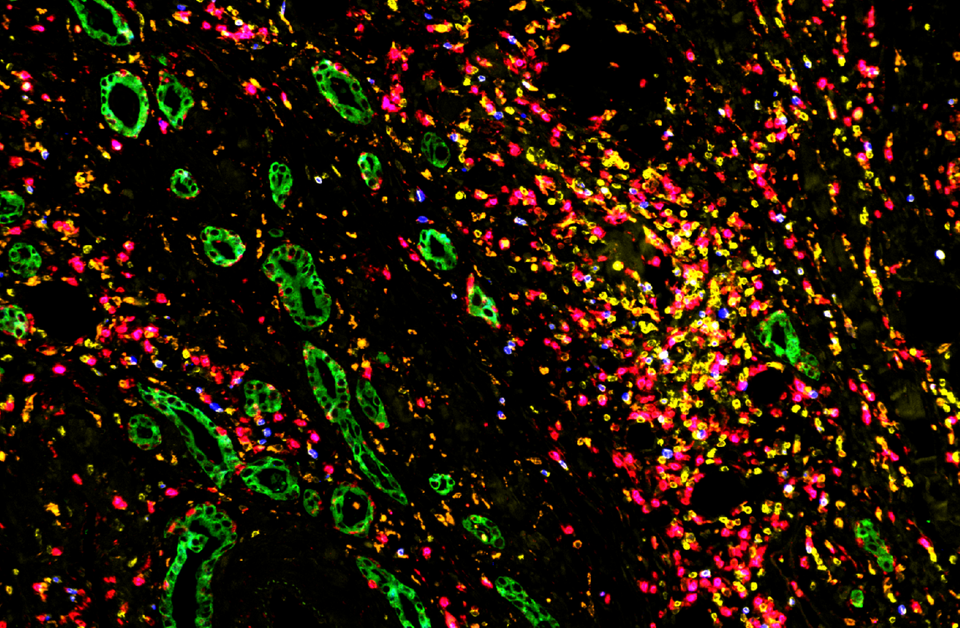

Abivax’s lead candidate, obefazimod, addresses these limitations by engaging the body’s endogenous regulatory pathways. It binds to the cap-binding complex on pre-mRNA to facilitate the splicing of a specific long non-coding RNA. This process selectively upregulates microRNA-124, a potent regulator that downregulates multiple pro-inflammatory cytokines, including TNF-alpha, IL-6, and IL-17. Rather than blocking a single target, this upregulation restores a natural immunological balance and dampens the cytokine cascade upstream without broadly suppressing the immune system.

The clinical viability of this mechanism was rigorously tested in the Phase 3 ABTECT induction program. In July 2025, Abivax released positive top-line results from two pivotal trials, ABTECT-1 and ABTECT-2, which evaluated 25 mg and 50 mg once-daily oral doses. The data for the 50 mg dose were statistically significant, demonstrating a placebo-adjusted clinical remission rate of 19.3% in ABTECT-1 and 13.4% in ABTECT-2 at week 8.

These trials enrolled a refractory population in which approximately half of the participants had previously failed advanced therapies, including JAK inhibitors. The ability of obefazimod to induce remission in this difficult-to-treat cohort suggests it retains efficacy even where other mechanisms have been exhausted. While the 50 mg dose was consistently effective, the 25 mg dose produced mixed results, suggesting that 50 mg will be the requisite induction dose and placing a spotlight on the drug’s tolerability. To date, obefazimod has demonstrated a favorable safety profile; unlike the JAK inhibitor class, which carries boxed warnings for cardiovascular events and malignancy, obefazimod has not shown signals of these severe toxicities.

Crucial to the commercial thesis for obefazimod is its intellectual property protection. According to the latest investor presentation, the core patents covering the composition of matter for obefazimod expire in 2030, while patents protecting its specific therapeutic indications extend into 2035. However, these dates do not account for standard regulatory extensions available in key markets, such as Patent Term Extension (PTE) in the United States and Supplementary Protection Certificates (SPC) in Europe. These mechanisms typically grant up to five years of additional exclusivity to compensate for the time lost during clinical development. Consequently, Abivax projects that obefazimod could maintain market exclusivity well into the late 2030s.

The commercial opportunity is substantial. The global market for ulcerative colitis therapies is projected to exceed $17 billion by 2032. However, obefazimod has the potential to capture a share of the broader IBD market; the combined market for IBDs is estimated to reach $44 billion by 2032. Abivax is actively pursuing this potential through its Phase 2b ENHANCE-CD trial in Crohn’s disease, which began enrolling patients in October 2024. If approved for both indications, analysts from Guggenheim have projected that risk-adjusted peak annual sales could reach approximately $5 billion. This valuation assumes obefazimod becomes the preferred oral therapy for patients progressing from 5-ASAs or steroids who are wary of the safety risks associated with JAK inhibitors.

Recently, intense speculation regarding a potential acquisition has surged. On Christmas Eve, the French newspaper La Tribune reported that high-level executives from Eli Lilly had met with French government officials to discuss the regulatory framework for a potential takeover. The involvement of the Ministry of Economy suggests that the French state is closely monitoring the future of this French biotech asset to ensure that domestic scientific interests are safeguarded in any cross-border deal. For Eli Lilly, acquiring Abivax would be a logical strategic move. Having entered the IBD space in 2023 with the injectable mirikizumab, Lilly lacks a potent oral option to compete with AbbVie’s Rinvoq or Pfizer’s Velsipity. Obefazimod would fill this gap perfectly.

But even without a buyout, Abivax is well-capitalized, reporting a cash position of €589.7 million as of September 30, 2025. This liquidity provides a cash runway extending into the fourth quarter of 2027, comfortably covering the critical maintenance data readout and the planned FDA filing in late 2026.

The definitive test for obefazimod will be the maintenance data expected in the second quarter of 2026. If the drug can sustain remission without the emergence of long-term safety issues, it will have cleared the final hurdle before regulatory submission. While the FDA has recently sharpened its focus on the safety of immune-modulating therapies, the agency’s recent approvals demonstrate a willingness to authorize new mechanisms that offer distinct benefits. If approved, obefazimod would represent the first new oral mechanism of action in IBD in years, which would be a potential revolution for patients facing surgery as their last option.

Follow me on X for frequent updates (@chaotropy).

Legal Information and Disclosures

General Disclaimer & No Financial Advice: The content of this article is for informational, educational, and entertainment purposes only. It represents the personal opinions of the author as of the date of publication and may change without notice. The author is not a registered investment advisor or financial analyst. This content is not intended to be, and shall not be construed as, financial, legal, tax, or investment advice. It does not constitute a personal recommendation or an assessment of suitability for any specific investor. Readers should conduct their own independent due diligence and consult with a certified financial professional before making any investment decisions.

Medical Disclaimer: Although the author possesses a medical background, the information presented here regarding medical technologies, clinical trials, or pharmaceutical mechanisms is strictly for the purpose of educational discussion and general commentary regarding the underlying science. It does not constitute medical advice, diagnosis, or treatment recommendations, nor does it establish a physician-patient relationship. Readers should never disregard professional medical advice or delay in seeking it because of something read on this website. Always consult a qualified healthcare provider regarding any medical condition.

Accuracy and Third-Party Data: Market trends, clinical trial data, and performance metrics referenced in this article are sourced from independent third parties. While the author believes these sources to be reliable, the completeness, timeliness, or correctness of this data cannot be guaranteed. The author assumes no liability for errors, omissions, or the results obtained from the use of this information.

Disclosure of Interest: The author holds a beneficial long position in Abivax Société Anonyme (NASDAQ: ABVX). The author reserves the right to buy or sell these securities at any time without further notice. The author receives no direct compensation for the production of this content and maintains no business relationship with the companies mentioned.

Forward-Looking Statements & Risk: This article contains forward-looking statements regarding regulatory outcomes (such as FDA decisions), clinical results, and market potential. These statements are predictions based on current expectations and are subject to significant risks and uncertainties. Investing in biotechnology and pharmaceutical securities involves a high degree of risk, including the potential for total loss of principal. Past performance is not indicative of future results.

Copyright: All content is the property of the author. This article may not be copied, reproduced, or published, in whole or in part, without the author's prior written consent.